Financial Interest Calculations

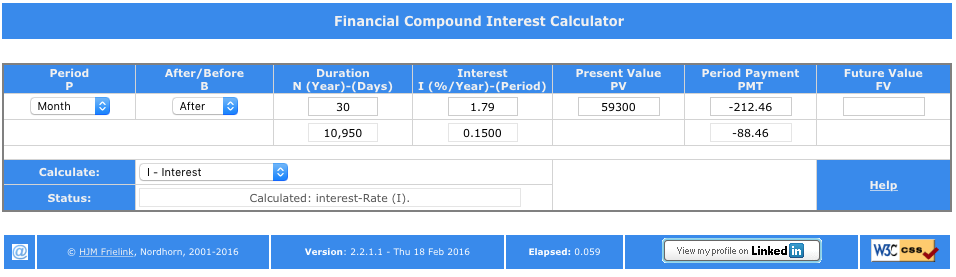

Financial Interest Calculators offer flexible methods for money and interest loans, mortgages and savings. The calculation is based on 5 main variables ( N, I, PV, PMT and FV. Given 4 of the variables the remaining can be calculated. Two additional variables make the calculator more flexible, the Period ( P) and After/Before ( B).

One example is my own version of the Financial Calculator written in Java and JavaScript. In case the calculator does not function as expected or you have other problems, please read the Help Section below.

Mechanism

A few agreements are used to enter the correct values to the variables.

| Type operation | Agreement | Applies to | Example Desctiption for Input Calculator. |

|---|---|---|---|

| Payments | Are always negative. Do not use a valuta-sign. | PV, PMT, FV | To enter a payment of €100,= use -100. |

| Receipts | Are always positive. Do not use a valuta-sign. | PV, PMT, FV | To enter a receipt of €250,10 use 250.10. |

| Durations | Are always positive | N | To enter a duration of 10 years use 10. |

| Interest | Are always positive and in percentages. | I | To enter 3.25% use 3.25. |

| Please Note | When the application is loading the applet, a blinking text Loading Java Applet, please wait... is shown in the right corner of the footer bar. After the applet has been successful loaded the text changes into Applet: Version: 1.0.1.6, Date: 11 Mar 2010 . |

Main Vars

Duration - N

The duration is measured in years. To make Period Payments possible during parts of the year use the Period - P settings to select the period. The duration can not be negative.

Example: In case of a mortgage with a duration of 30 years, input 30 (N = 30).

The row below contains the calculated duration in days (i.e. Duration is 10 years meaning 10 x 365 = 3,650 days).

Interest - I

The Interest is always given as a percentage per Year. The row below contains the Interest calculated as rate per Period.

Present Values - PV

The Present Value is the current or now value. Do not use valuta-sign and use a decimal point as separator. Comma fields are not allowed.

Example: In case of a mortgage enter the total sum of the mortgage here as a positive value (250000).

Period Payment - PMT

The Period Paymemt is the amount of money which is received (positive value) or payed (negative value). The number of receipts/payments per year depends on the chosen value of Period - P.

Example: In case of a mortgage enter the Periodical Payment here as a negative value (-1000).

Future Value - FV

The Future Value is the amount of money which is received (positive value) or payed (negative value) at the end of the duration.

Example: In case of a linear mortgage the end-value will zero (0).

Additional

Period - P

The Period chosen here is used for creating multiple Period Payments per year (PMT). Valid options are Half-year, Quearter, Month, Week and Day.

Example: In case of a mortgage normally the period is a month.

After/Before - B

The value before after in combination with the Period P is used to indicate payment before or after the chosen period. Example when chosen for the above setting and moving the After/Before switch to Before will result in an Interest Percentage of 3.2317% per Year in stead of 3.250%.

Example: In case of a mortgage the normal value is after.

Example Mortgage

top

Buying a house with a mortgage of € 250,000.- (PV = 250000), a End-Monthly (B= After, P = Month) Period Payment of €1,000.- (PMT = -1000) and a duration of 30 Year (N = 30) the Interest will be 2.6245% per year.

Same example but now with an Interest of 3% will yield to an Period Payment of €1,048.56 (-1048.56).

And when you put that amount of money on a bank with 3% Interest? Leave (After/Before B = A, Duration N = 30, Interest I = 3, Period Payment PMT = -1048.56). Change:

- PV = 0

And calculate the Future Value will yield € 606,815.34 (606815.34).

How much money did you actual pay? Change:

- I = 0

Resulting in € 37,8000.- (378000).

Help

The calculator engine is written in Java and is launched using Java Network Launching Protocol (JNLP). To use the Apple you have to have installed Java Version 1.6 or higher. If you have not installed Java, please see the Java installation for your browser.

if the correct version of Java is installed this mechanism works fine on Windows and Linux. But unfortunately not on Apple Mac OS. The settings for JNLP Applets on OS X is totally ignored by default, so this feature has to be enabled by switching to run applets in their own process in the Java Preferences Panel [1]. The Java Preference Panel is located in the Applications -> Utilities, choose the General tab

See also

- Financial Interest Calculator by Harm Frielink

- Pensioen, Intrawiki Pensioen van HaFr.

References

- ↑ Getting Java Applets to Work on Mac OS, Are you having trouble viewing some Java applets on a Mac? Got next generation Java Plug-in?